Gold investors may not have had much to root for in 2015, especially after a dismal 2014, but on the exchange-traded fund securities market, gold has been one of the best performers of all. Mike McGlone of ETF Securities notes that gold is in a “re-acceleration pattern” and has performed better than most other commodities on the market. Even so, the past week wasn’t kind to gold, yet again, losing big after the Greece news but re-gaining some value through the last half of the week.

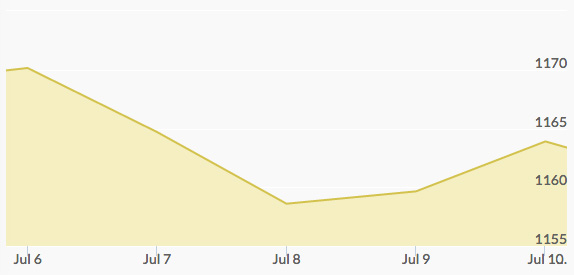

Monday saw gold take a $15 per ounce hit, falling to a three-month low at $1,157 per ounce. Silver pricing did even worse than gold, dropping by no less than three percent overall. The Greece decision to vote no on the debt repayment plan hit gold hardest, taking the broader stock market with it. Despite the 1% loss for gold, the Dow Jones lost twice that figure.

What was bad on Monday got worse on Tuesday, dropping another ten dollars per ounce at the low point and then climbing slightly to close out the trading day at $1,156. The continued downfall came again at the hands of the Greek news. Platinum performed even worse, dropping by a full twenty dollars, or two percent, per ounce.

Good news finally arrived on Wednesday as the price of gold gained two and a half dollars per ounce for the first time in the past six days of trading. Contracts moved were quite high at over 130,000, indicating the possibility of a bull market on the horizon.

Thursday was good news all around. Clade Resources released a report that their gold output was up ten percent compared to last year, indicating that gold mining companies are doing well despite the lower cost of their product. Gold rose by a modest figure to close out the day at $1,163.

Friday saw slight gain as gold finished the week at $1,164, a five-dollar loss from the start of trading on Monday but a twenty-dollar increase from the low point of the trading week on Tuesday. The Greek standoff remains the big negative for the gold market, while the continued collapse of the Chinese stock market contributed to lower prices and less confidence in turn.