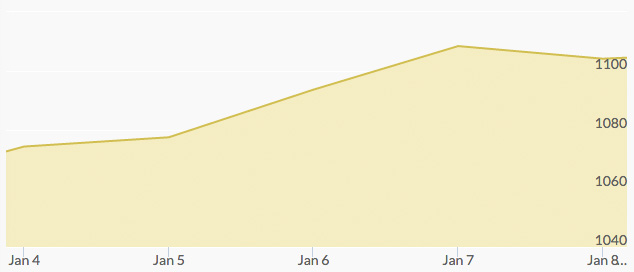

It was a great start to a new year for gold the week of January 4–8, 2016. Despite having lost 10% by the end of 2015, gold gained enough this week to emerge over the $1,100 mark. Starting on Monday, gold rallied 2% to reach $1,080 per ounce, in response to tensions in the Middle East and weak manufacturing data from China.

Oil prices were up 2.4% after Saudi Arabia cut off ties with Iran because Iranian protestors stormed the embassy after the Saudi execution of a Shiite cleric. Sound messy? It is. Gold became desirable as a safe haven investment once again, especially since Saudi Arabia controls so much global oil.

Meanwhile, China’s weak economic data caused a sharp decline in the stock market because of concern over global economic growth. China’s securities regulator added $20 billion to domestic money markets, essentially an act of inflation to keep a struggling economy afloat.

Markets stabilized on Tuesday, and gold maintained. By Wednesday, gold enjoyed more gains and reached a one-month high as stock markets, oil U.S. Treasury yields and the Chinese Yuan all drastically fell. The Yuan hit 5-year lows as investors were moving their money out of China.

This week’s gold prices were heavily influenced by geopolitical tensions. Mid-week North Korea announced they were testing a hydrogen bomb. Gold once again becomes favorable when myriad other global economic and political factors are threatening or uncertain.

By Thursday, the stock market had plunged for six days in a row, sparking fears of a global slowdown; gold prices hit $1,110—a two-month high. In general, now that the Federal Reserve’s interest rate hike has been priced into the value of gold, the yellow metal is once again shining as a fallback measure of security in tough times.

On Friday, gold retreated slightly, back down to $1,105, after U.S. economic reports announced an additional 292,000 jobs in December, which was 50% more than what was expected.