The yellow metal opened this week slightly lower, having clocked in a five-week low over the weekend. European markets were closed for Easter, and both U.S. and Asian markets were relatively quiet. However, the recent attitude in the market has been more tolerant of risk, so the safe haven of gold is less attractive. Even with terror attacks on Brussels and Pakistan, the financial world has been less responsive than might be expected. Yet, the terror attacks are bringing focus to global instability.

Two Federal Reserve members, James Bullard of St. Louis and Patrick Harker of Philadephia, have recently released hawkish statements about raising interest rates in 2016, causing more concern in gold markets. 1 Meanwhile, the negative interest rate policies recently instituted by the European Central Bank could cause economic trouble, and gold investors are watching this financial situation for clues.

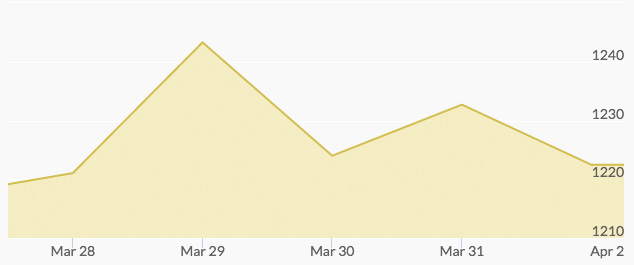

On Tuesday, Janet Yellen released statements at the Economic Club of New York that she is still concerned about global market repercussions, an indication that the Fed could likely hold off on raising interest rates, a definitely dovish stance. The relevance to the gold market is that these comments serve to weaken the dollar, which generally pushes gold prices up. The price of gold got a boost Tuesday but slid again through Wednesday.

On Wednesday, the U.S. employment report for March announced a jobs gain of 200,000, in line with expectations. Gold did not respond. The next bit of U.S. economic news was released on Friday, showing an additional 10,000 jobs added to the market. The price of gold fell to a 3-day low. Still, final tallies for the first quarter show gold to be up around 16% since the beginning of the year, the largest quarterly gain in almost 30 years.

Additional Sources:

1 http://marketrealist.com/2016/03/fed-members-hawkish-statements-affected-gold-prices/