Amid political and economic uncertainty at home and abroad, many Americans are wondering, “Is Gold a Good Investment in 2017?” The short answer is a strong affirmative. The gold price forecast for 2017 is positive, with analysts’ predictions ranging from $1,200 by mid-year to $1,500 by yearend. It is worth understanding the source of their expectations: a brief look at 7 factors influencing the gold market in the coming year provides significant insight.

Read the latest year’s post here: Is Gold a Good Investment?

Why Is Gold a Good Investment in 2017?

Financial markets are increasingly complex and opaque structures that make it challenging to assess near-term trends. However, they ultimately respond to basic fundamentals that determine asset prices. Underlying dynamics can often be blunted for short periods—but are the final arbiters over the long term.

These realities continue to surface, shocking economic and political systems and strengthening the case for investing in safe haven assets like gold. Rather than an aberration, it is now believed that Brexit was the “canary in the coal mine.” This event alerted investors and traders to the precarious global financial environment and the protection gold could offer in the coming year.

7 Reasons to Buy Gold in the New Year

1. When Safe Havens Rule

Few investors and even professional traders alive today can recall a time when there was more global economic turmoil. The constant drumbeat of bad economic news has become commonplace, and everyone seems to be waiting for the next financial-crisis shoe to drop. Moreover, many traditional “safe investments” like government bonds are experiencing record low yields.

These alarming realities are driving many to look again at the long-proven stability and safety of gold. As one of history’s most preferred safe haven investments, this lustrous yellow metal is in the financial spotlight for a reason. It is again the choice of many concerned investors and financial managers seeking peace of mind and protection.

The more serious investors evaluate the situation, the grimmer the outlook for the global economy: sluggish growth in mature economies, stubbornly low commodity prices, scrawny global trade, and diminishing capital flows. There is value in looking further at several of the conditions underlying these trends to understand why so many seasoned market participants see investing in gold as prudent.

2. The Paper Currency Experiment: A Looming Disaster

Since the time of World War II, governments have been involved in a grand experiment with national and global economies based on fiat money. The paper money that all governments have adopted is backed only by the credit of the countries issuing it. Unfortunately, many politicians have found license in this experiment to print money—or worse, created digital money—in endless quantities, supporting massive deficit spending and unsustainable, growing levels of debt.

There are only two possible outcomes from such ongoing monetary irresponsibility, and neither is pleasant. Either economies collapse and a period of deflation is required to adjust the books, or sustained inflation/hyperinflation takes control of the economic engine. The end result is simple: a significant loss in the value and purchasing power of paper money.

Many are aware of the fact that gold has historically served as an excellent hedge against inflation by protecting purchasing power. However, few understand it provides equal value in a deflationary economy. While paper currency is valued at the whim of the government, the markets are the real and final arbiters of what will ultimately serve as a true medium of exchange.

When the consumer and markets lose faith in a paper currency, it has the potential to become worth less than toilet paper. On the other hand, gold has never lost its intrinsic value in the local and global market.

While the Fed fought to stave off deflation for years, many analysts assert that we’re entering a period of reflation and that inflation is on the horizon. Financial advisors are warning that now is the time to diversify portfolios and invest in gold to protect their purchasing power.

3. The U.S. Dollar and Investing in Gold

Beyond its role as our fiat currency, the U.S. dollar is currently the world’s leading currency for trade and international finance. Due to numerous factors, the dollar will cycle from being strong or weak relative to other foreign currencies. When the dollar is weak, gold offers greater value, while the opportunities to purchase gold at favorable prices come with a stronger dollar.

This generalization of the inverse relationship between the price of gold and the strength of the dollar is another way of viewing how the market views safety. If the U.S. economy is operating at top efficiency and the dollar is strong, it provides investors with a sense of security and they purchase and hold dollars. That demand reinforces the perception of strength, and the dollar provides the desired haven in that environment.

Today, the artificially strong dollar, maintained by the Fed’s actions, is under attack on a number of fronts: it is a major factor in our economic stagnation, effectively swelling the country’s trade deficit. The strong dollar has also depressed the price of gold, presenting buying opportunities in recent years; however, this should not be considered a gold price forecast because the strength of the dollar is expected to diminish.

4. Bank and Fiat Failures

History shows that the faith of the people is a fundamental factor in every economic system. Fears create self-fulfilling failures, and there is much in today’s global paper currency economies to cause alarm.

When banks fail in increasing numbers, people lose faith in fiat currencies. Those fears were at the root of the massive failures during the Great Depression. The markets saw a version of this same dynamic during the Great Recession of the past decade. Today, similar anxieties are felt over the Italian banking system and even Germany’s Deutsche Bank.

In such times, people panic and invest in gold as a hedge against economic uncertainty, and that increase in demand drives up gold prices. This role as a safe haven is why even central banks view gold as a fundamental way to shore up a perception of stability.

5. Central Bank Gold Holdings

Central banks play a major role in the swings in the world’s supply of gold. It is clear evidence of the reverence held for gold as an indicator of wealth and stability that central bank holdings of this precious metal are closely monitored. Today, at least 30,000 tons of gold are held in government vaults, roughly 18 percent of the world’s supply.

These banks will buy and sell gold based on different global and national needs, and their actions play a significant factor in gold supply and demand, and therefore gold prices. There is also a major psychological impact on the gold market based on central bank activity.

These governments know gold holdings are a major indicator of stability, and they are investing more today in light of global economic instabilities. Central banks also view gold as a safe haven, and an excellent diversification from paper currencies. Are they now sharing the same perspective as that of seasoned buyers of gold?

6. The Effect of Interest Rates: High or Low

There is traditional market wisdom that high interest rates drive gold prices lower. In fact, the Fed is an astute student of this insight. This is based on the simple fact that gold pays no dividends or interest, making bonds or other instruments more attractive.

While short-time market players react to even minute interest rate swings, long-time investors and buyers of gold look to the fundamentals behind those cycles. Moreover, they generally see times of high interest as an opportunity to add to their portfolio at attractive prices.

Although interest rates have been at historic lows for nearly a decade, largely as a result of central bank actions, the Fed raised them in December 2016 to the range of 0.5 percent to 0.75 percent. The organization stated that it plans to raise rates again this spring. 1 This presents purchasing opportunities for wise investors.

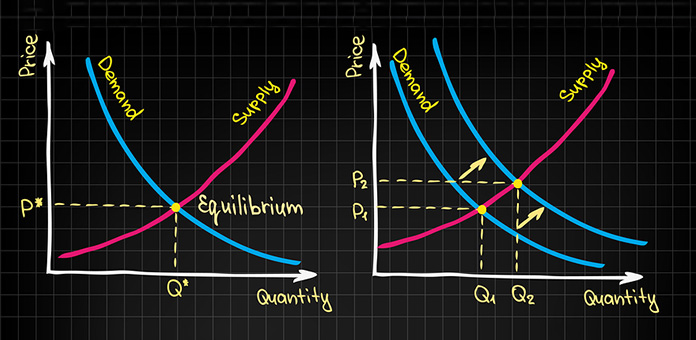

7. Supply versus Demand

Ultimately, all the combined factors that affect the price of any commodity, such as gold, come down to supply and demand.

The dynamics discussed above primarily speak to the rise in demand for gold as an investment, not to industry, technology, and medicine’s use of the precious metal. However, both impact the supply of gold.

The supply of gold is finite due to limited amounts above ground, and production costs ensure that supply will only rise when price increases justify it. While few in the marketplace have really addressed this issue, some analysts are raising the alarm. One Goldman Sachs analyst actually states that, “We have only 20 years of known mineable reserves of gold.” 2

To Buy or Not to Buy Gold

The ultimate goal of all investing comes down to two fundamental goals: protecting and increasing the purchasing power of your portfolio. Discussed above are only 7 of the numerous factors that support gold as an inflation hedge and wealth protector.

The challenge for many is to wake up to this current global financial environment and take proactive steps to meet those primary investment goals. Certainly, for a large number of individuals, purchasing gold is one of the most important of those actions.